The tax-filing season officially is underway: The IRS now is accepting tax returns for 2022, so the countdown has begun to Tax Day, which this year falls on April 18.

If you hope to get a tax refund this year — especially if you want it to be big or arrive quickly — here is everything you should know. We’ve also got a tip for what you can do right now to ensure that the refund you receive is the right size for you.

1. Your refund might be smaller this year

Brace yourself: Due to federal tax law changes and other factors stemming from the COVID-19 pandemic, you might receive a smaller refund — or a larger tax bill.

This is more likely to happen to taxpayers affected by the changes we reported in “5 Reasons Your Tax Refund Might Be Smaller This Year.”

2. It’s not too late to try to fatten your refund

Once your tax software or tax professional has entered everything required on your tax return, they will know the exact size of your refund (assuming they didn’t make any errors). If you are disappointed in that number, you might able to change it before your software or tax pro sends your return to the IRS.

The best time to ensure a fat refund for the 2022 tax year was before 2022 ended, but there are a few options still available.

For example, you have up until Tax Day — April 18, 2023 — to make a contribution (or to contribute more money) to your traditional individual retirement account (IRA) or health savings account for the 2022 tax year. And doing so would qualify you for a tax deduction you could claim on your 2022 return, assuming you’re otherwise eligible, thereby increasing your refund or decreasing your tax bill.

3. Electronic filing and direct deposit speed your refund

Filing your tax return electronically and opting to receive your refund via direct deposit into your bank account — rather than, say, via mailed check — is the best way to speed your refund, according to the IRS. Most people receive their refunds in less than 21 days this way.

Filing electronically also is the best way to minimize errors, which in themselves can delay your refund. The IRS explains:

“Although most refunds are delivered in 21 days, it could take longer if the tax return includes errors, is incomplete or requires further security review. Paper-filed tax returns and paper refund checks will take even longer this year.”

4. Filing early helps protect your refund from crooks

Filing your taxes early on in the season helps keep criminals from exploiting your tax information for their own gain.

As we explain in “Beware These 6 Income Tax Scams,” thieves who get hold of your personal information can then turn around and file a tax return in your name:

“They use your name, address, Social Security number and other personal data to fill out and file a fake tax return in your name. Then, they get a big refund. Meanwhile, the IRS rejects your actual return because the agency thinks you already filed.”

The earlier in the tax-filing season that you file your return, the less time crooks have to pull off such a scheme. But there is an exception to this …

5. Rushing your return can slow your refund

While it’s smart to file your tax return sooner rather than later, there is such a thing as filing too soon.

The IRS urges taxpayers to have all their 2022 tax documents in hand before filing their return. This will help avoid errors and thus avoid refund delays.

For a look at the types of documents you need in hand before filing, check out “Don’t File Your Taxes Until You Have These 7 Things.”

6. Claiming certain tax credits can slow your refund

If you claim the earned income tax credit or the additional child tax credit, the IRS won’t issue your refund before mid-February. This is required by law and designed to prevent fraudulent refunds.

7. You can split your refund between multiple accounts

Another benefit of receiving your refund by direct deposit is that you can choose between having the entire amount sent to one account or having it split up between two or three. These can be bank accounts or individual retirement accounts.

So, you could have a portion of your refund deposited into your checking account, another portion into your savings account and the rest into your IRA, for example.

Breaking up your refund is easiest if you use tax software or tell your tax professional, but you also can do it on paper using Form 8888.

8. You can use your refund to buy bonds paying 6.89%

In addition to splitting your refund between multiple accounts, Uncle Sam gives you the option to use all or part of your refund to buy U.S. savings bonds. Specifically, you can buy up to $5,000 worth of Series I savings bonds with your tax refund.

Due to inflation, these bonds happen to be a decent investment right now, as we reported in “This Savings Bond Now Pays Nearly 7% — Should You Buy?”

Using all or part of your refund to buy savings bonds is easiest if you use tax software or tell your tax pro, but you also can do it on paper using Form 8888.

9. You can check the status of your refund online

Once you’ve filed your return, you can check the status of your refund by using the Where’s My Refund? tool on the IRS website or by using the IRS2Go mobile app. Both options are free.

Generally, refund information will be available via the online tool and mobile app within 24 hours of the IRS acknowledging receipt of an electronically filed return. If you file a paper tax return, don’t expect to find your refund information online for six months or more.

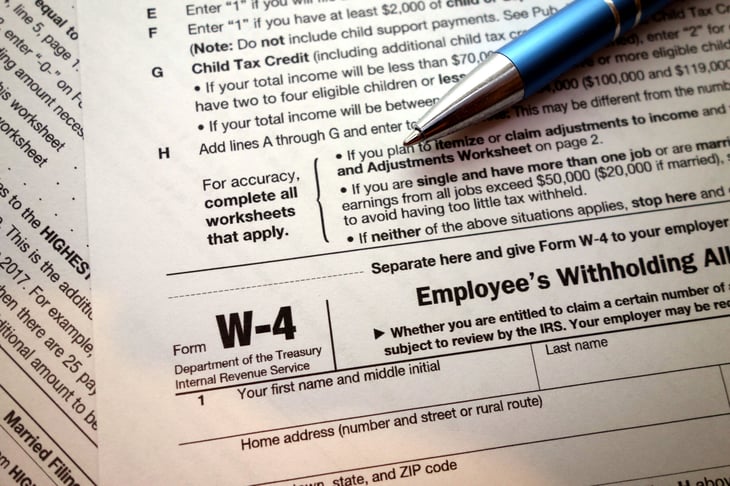

10. It might be time to adjust your withholding

If you are disappointed by this year’s tax refund — or even worse, if you find that you owe money — you can avoid a similar fate next year by adjusting your withholding now.

Having more money taken out of your paycheck — or even your retirement income — for taxes throughout the year will mean you are less likely to owe money to Uncle Sam at tax time, and more likely to get a refund.

Of course, getting a refund is not necessarily a good thing. It means you effectively gave an interest-free loan to the government.

That is another reason why adjusting your withholding now is smart. You can do this online using the IRS’ free Tax Withholding Estimator tool.

If you decide to adjust the withholding from your:

11. You can make your refund more valuable

Like any windfall, a tax refund could be worth more than its face value — if you put it to use in a way that saves you money or builds your wealth.

If you don’t want to invest it in U.S. savings bonds, you can find more options in “6 Ways to Use Your Tax Refund to Become Richer.”